Business Rates Data Card

Use the business rates data card to better understand what the latest UBRs are, and what reliefs, schemes and grants may be applicable to your property portfolio.

Scotland

Small Business Bonus Scheme (SBBS)

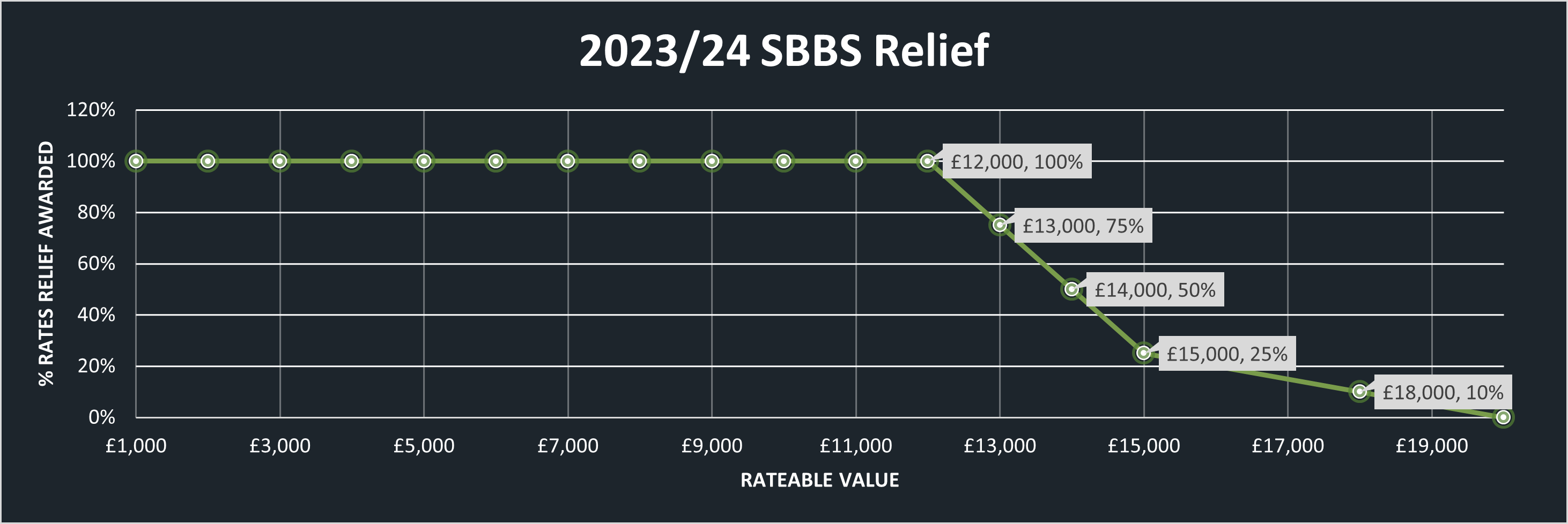

The Scottish Government is tapering the SBBS relief for properties between £12,001 and £20,000: relief will taper from 100% to 25% for properties with Rateable Values between £12,001 to £15,000; and from 25% to 0% for properties with Rateable Values between £15,001 to £20,000.

The combined Rateable Value of all business premises must be £35,000 or less and, the Rateable Value of individual premises is to be £20,000 or less.

Small Business Transitional Relief will be available to properties that lose SBBS eligibility. The loss of eligibility will be in a phased manner. For those losing or seeing a reduction in these reliefs (including due to the above exclusions introduced for SBBS relief) on 1 April 2023 the maximum increase in the rates liability relative to 31 March 2023 will be capped at £600 in 2023/24, rising to £1,200 in 2024/25 and £1,800 in 2025/26.

Small Business Transitional Relief will be available to properties that lose SBBS eligibility. The loss of eligibility will be in a phased manner. For those losing or seeing a reduction in these reliefs (including due to the above exclusions introduced for SBBS relief) on 1 April 2023 the maximum increase in the rates liability relative to 31 March 2023 will be capped at £600 in 2023/24, rising to £1,200 in 2024/25 and £1,800 in 2025/26.

Small Business Transitional Relief will be available to properties that lose SBBS eligibility. The loss of eligibility will be in a phased manner. For those losing or seeing a reduction in these reliefs (including due to the above exclusions introduced for SBBS relief) on 1 April 2023 the maximum increase in the rates liability relative to 31 March 2023 will be capped at £600 in 2023/24, rising to £1,200 in 2024/25 and £1,800 in 2025/26.

Small Business Transitional Relief will be available to properties that lose SBBS eligibility. The loss of eligibility will be in a phased manner. For those losing or seeing a reduction in these reliefs (including due to the above exclusions introduced for SBBS relief) on 1 April 2023 the maximum increase in the rates liability relative to 31 March 2023 will be capped at £600 in 2023/24, rising to £1,200 in 2024/25 and £1,800 in 2025/26.